If 2020 was the annus horribilis for the car industry, as for the rest of us, then 2021 isn't looking much better so far. While the vaccine rollout that will hopefully release us from this COVID hell continues, car buyers are staying away from both physical dealerships and the 'click-and-collect' button online.

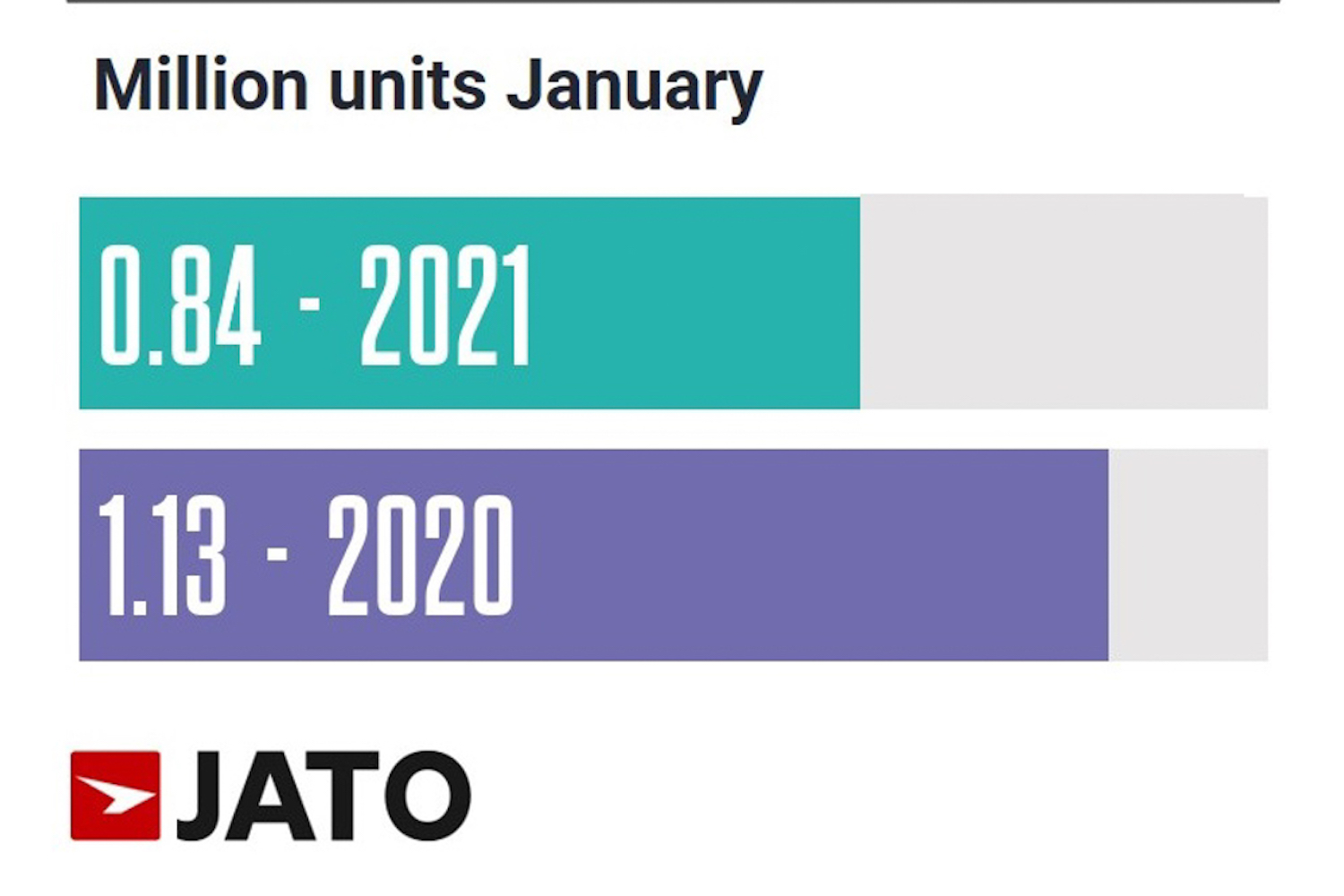

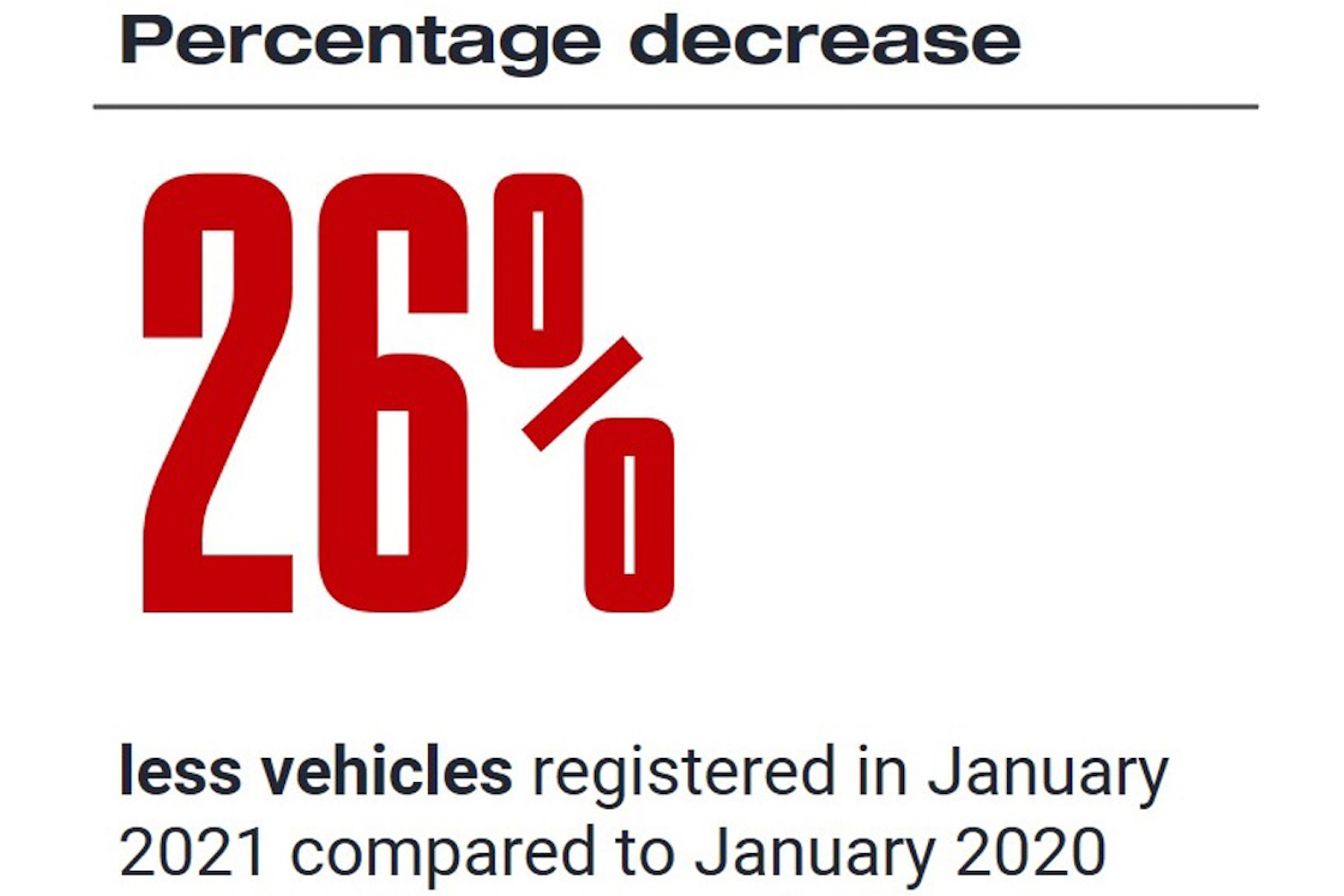

Fewer than one-million sales in January

According to JATO Dynamics, the London-based motor industry analyst, European new car sales were down 26 per cent in January, compared to January 2020. 839,525 new cars were sold across the 27 EU member states, which makes it the worst-performing January since 1982.

Felipe Munoz, global analyst at JATO Dynamics commented: "Despite efforts made by governments and carmakers to boost the registration of pure electric cars, it has not been enough to offset the impact of the global pandemic and local lockdowns."

Germany and Spain, two of the biggest markets, saw January sales falls of 32 per cent and 52 per cent respectively, although some of the drop-off is down to changes in taxation. Just as Ireland changed its motor tax system over to the new WLTP test results in January, and changed its motor tax bands as a result, so too did many other European authorities. "Changes to tax calculations from January 1st accelerated the demand in December, with consumers registering new vehicles ahead of these changes" said Munoz.

SUVs now make up the majority of sales

There were a few glimmers of hope in the mud of lockdown depression. The Swedish new-car market actually rose by 23 per cent, in part because of changes to its car tax regime. Norway also saw an uptick in its market, of eight per cent, thanks to continued strong demand for electric vehicles, driven by massive EV incentives.

In the wider picture, our appetite for SUVs and crossovers seems to show no sign of abating. Of the cars that were sold in Europe in January, some 44 per cent were classified as SUVs, the highest share ever recorded. Munoz noted: "The demand for SUVs shows no signs of stagnation, and Europe is showing similar patterns of growing popularity to those seen in the USA and China. Considering their higher prices and emissions levels, the results are particularly noteworthy."

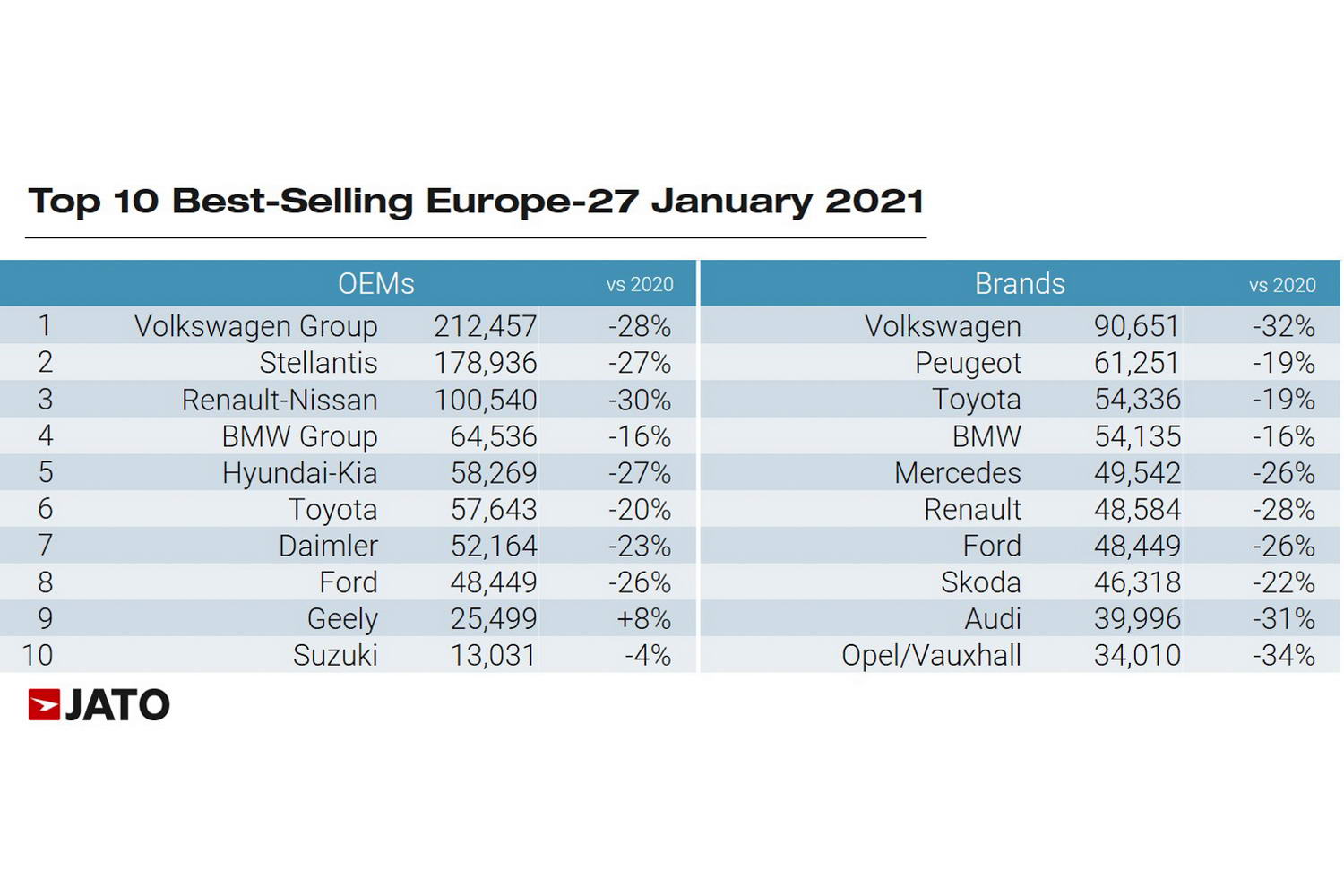

In terms of best-sellers, Volkswagen Group, as a whole, finished on top, with the Volkswagen brand topping the brand sales charts. By group, Stellantis (the newly-conjoined supergroup of PSA and Fiat-Chrysler) finished in second place, followed by Renault-Nissan, BMW, Hyundai-Kia, Toyota, Daimler, Ford, Chinese carmaker Geely (which owns Volvo), and Suzuki.

Yaris and XC40 see big success

In brand terms, behind Volkswagen were Peugeot, Toyota, BMW, Mercedes, Renault, Ford, Skoda, Audi, and Opel.

The best-selling car of all was the Toyota Yaris, with 18,000 sold across Europe. That was closely followed by the Peugeot 208, and then the Dacia Sandero, with the Volkswagen Golf just behind. The best-selling SUV was the Peugeot 2008. Curiously, the best-selling premium badge car was the Volvo XC40, its volume soaring by 58 per cent to 10,590 units. Other models that posted significant increases included the Ford Puma (+72 per cent), Ford Kuga (+258 per cent), BMW X3 and Kia Niro (+12 per cent each), Mercedes GLA (+18 per cent), Suzuki Ignis (+25 per cent), Smart Fortwo (+208 per cent) and Porsche Macan (+23 per cent). Among recently launched cars, the most registered were the Mercedes GLB (3,802 units), Volkswagen ID.3 (2,909 units), Cupra Formentor (2,826 units), Citroen C4 (2,491 units), BMW 2 Series Gran Coupe (2,409 units), Polestar 2 (1,290 units), Porsche Taycan (1,017 units), Toyota Proace City Verso (915 units), Audi e-tron Sportback (908 units), and Land Rover Defender (871 units).