The European Commission, under its president Ursula von der Leyen, has announced an official investigation into possible underhand practices by Chinese car makers.

Below-cost 'dumping'

For some time now, there have been rumblings within the car industry that Chinese car makers are essentially 'dumping' new cars, especially electric cars, at below their cost price in an effort to undermine the major European manufacturers.

Indeed, that's precisely what von der Leyen is directly accusing the Chinese car makers of doing, with the assistance of their government. "Global markets are now flooded with cheaper Chinese electric cars. And their price is kept artificially low by huge state subsidies," von der Leyen said in her annual State of the Union address. "This is distorting our market."

Previously, the chief executive of the vast Stellantis Group, Carlos Tavares, had called for extra import duties to be placed on Chinese cars being sold in Europe, on the basis that European brands have to pay a tariff of between 15 and 25 per cent to enter the Chinese market. A probe by the Commission doesn't automatically mean that such tariffs might be applied, but it's probably a step in the direction that Tavares would be pleased with. It's worth noting that Tavare's great French brand rival, Luca De Meo, the head of Renault Group, has said that Chinese brands shouldn't be hindered and that European brands can compete.

France and Germany welcome the move

Two major European government officials have welcomed von der Leyen's announcement. In a press conference, French economy minister Bruno Le Maire said: "If these subsidies do not comply with the rules of the World Trade Organization, Europe must be able to fight back."

Le Maire was joined on stage by his German counterpart, Robert Habeck, who said: "It is about unfair competition. It's not about keeping high-performance, low-cost cars out of the European market; it's about looking to see if there are hidden, direct or indirect subsidies that create an unfair competitive advantage."

However, it's not as simple as that. European car brands rely - as do all car brands now - on the Chinese market, simply because it is the largest in the world. If China responds to the EU's moves with increased tariffs, or other restrictions, then it could be disastrous for sales of European cars in China. Equally, if the move is publicised, then Chinese buyers may just move away from purchasing European cars out of a sense of patriotism.

Monopoly status

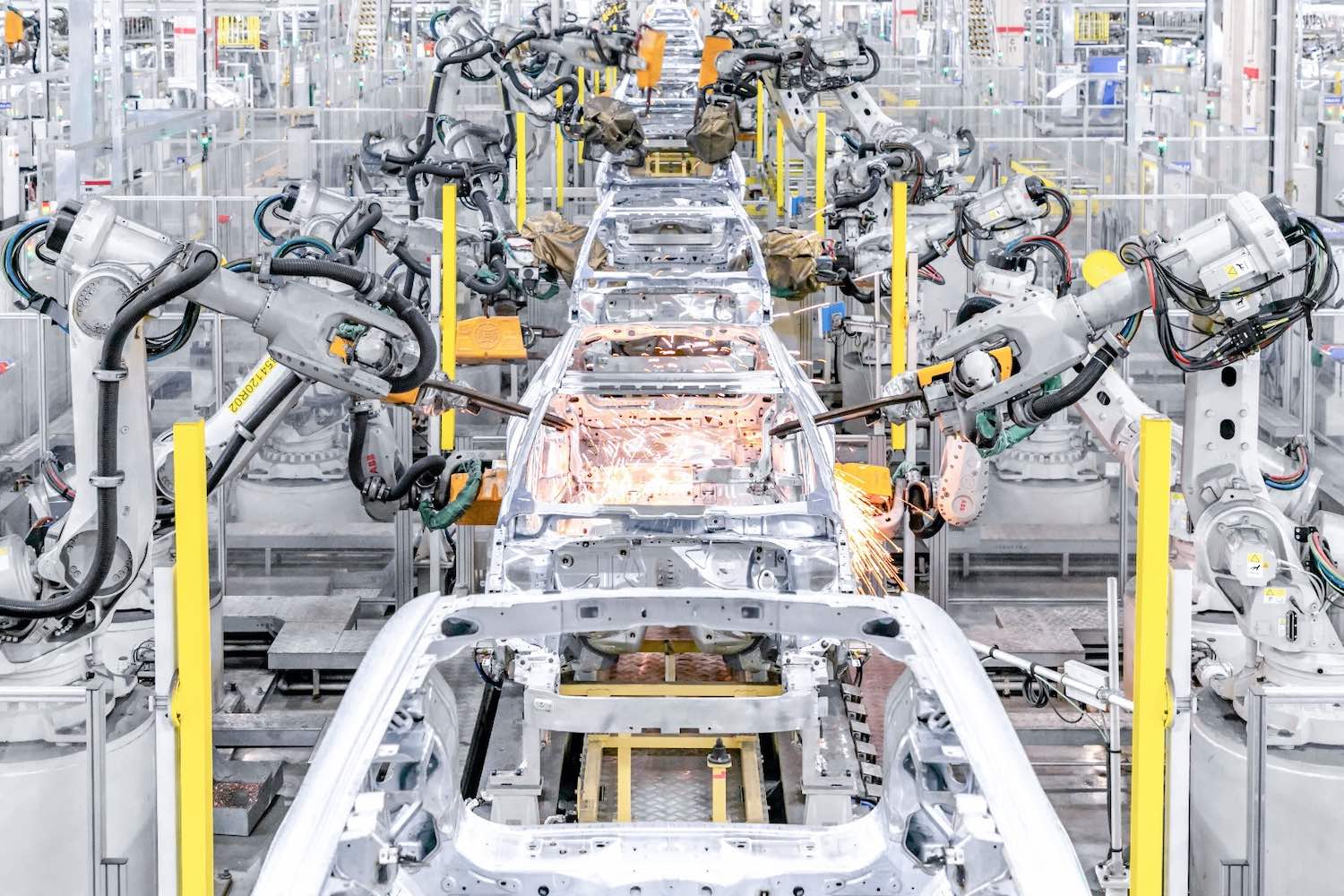

China has spent years, and billions, positioning itself as a global leader in electric car manufacture, as well as battery construction and the processing of the chemicals and metals needed for batteries. It's not quite reached monopoly status in either area, but it's not a million miles away, hence the EU's concerns, which are broadly reflected in the US.

There is another complication, however, which is that many European and American brands have developed strong ties with Chinese EV and battery manufacturers. BMW is collaborating with Great Wall Motors on the EV platform for its next-generation electric MINIs; Ford is opening a vast battery plant in Michigan in co-operation with China's CATL; Volkswagen and Audi have recent announced links with SAIC (owners of MG) and XPeng to share EV chassis and platforms.

Equally, some European brands are outright owned by Chinese car makers - Volvo, Polestar, and Lotus are all owned by the giant Geely corporation, for example. Car makers from both Europe and China are indelibly intertwined.

However, the launch of the probe could equally be something of a feint - the EU is currently in discussions with China about the Asian giant lowering its trade tariffs with the European bloc, and it could be a case of if China makes the tariffs go away then the EU might conveniently forget about the investigation.

Equally, there are some analysts who point out that Chinese cars aren't being sold here below cost - they're profit-making at lower prices because of the huge government-backed investments made in China to build up its car-making industrial base.

A report by Allianz Trade has predicted that Chinese car brands are expected to steadily increase their European market shares in the coming years, taking a potential €6 billion in collective sales away from the big European companies.

Will this EU investigation put a dent in that? We shall have to wait and see.