While the past few months have seen a succession of headlines about falling electric car sales, the early months of 2024 have actually seen a recovery for battery cars, at least in some key European markets. However, one major market is still seeing a fall in sales, and it’s dragging the average down.

Why is Germany holding the rest back?

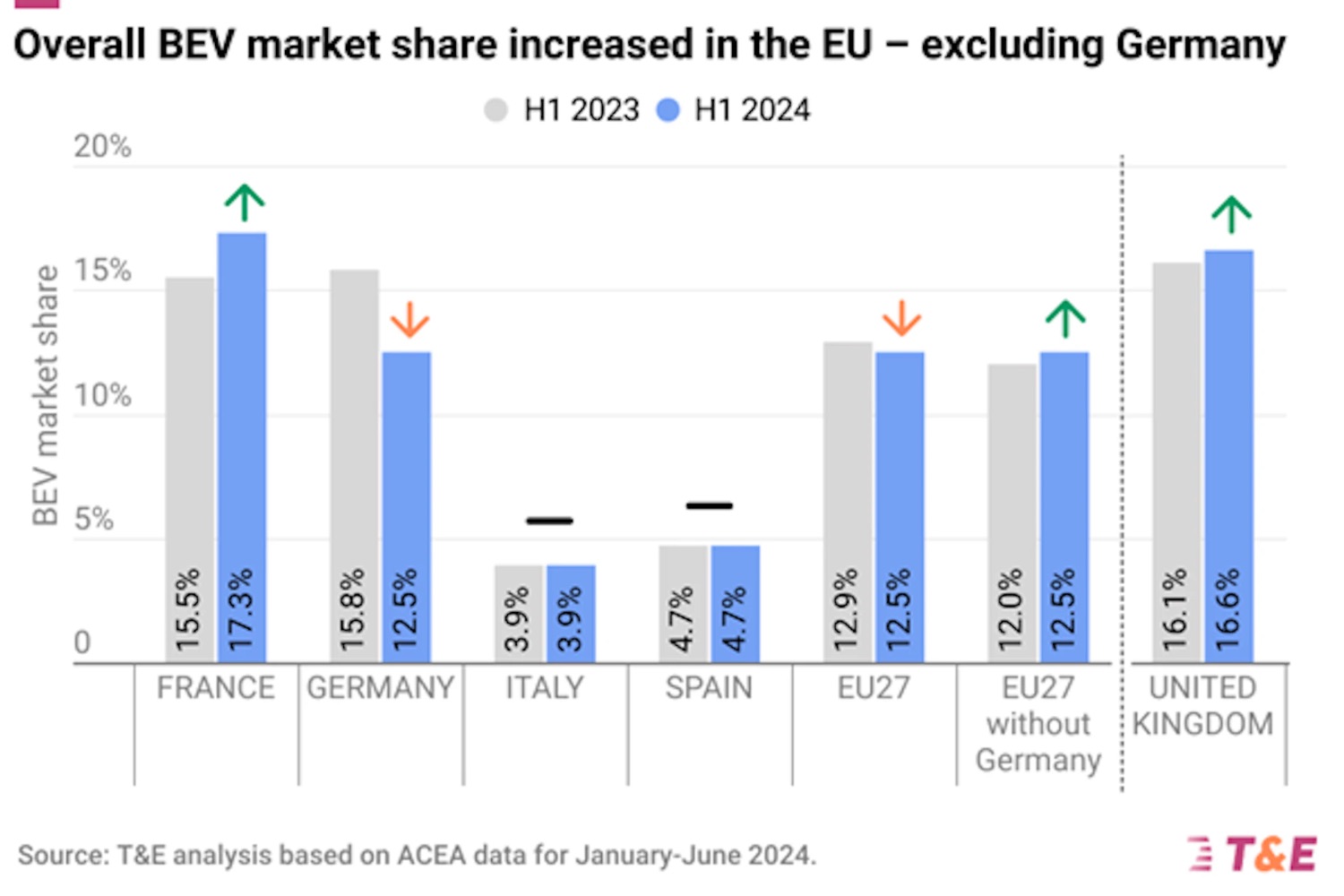

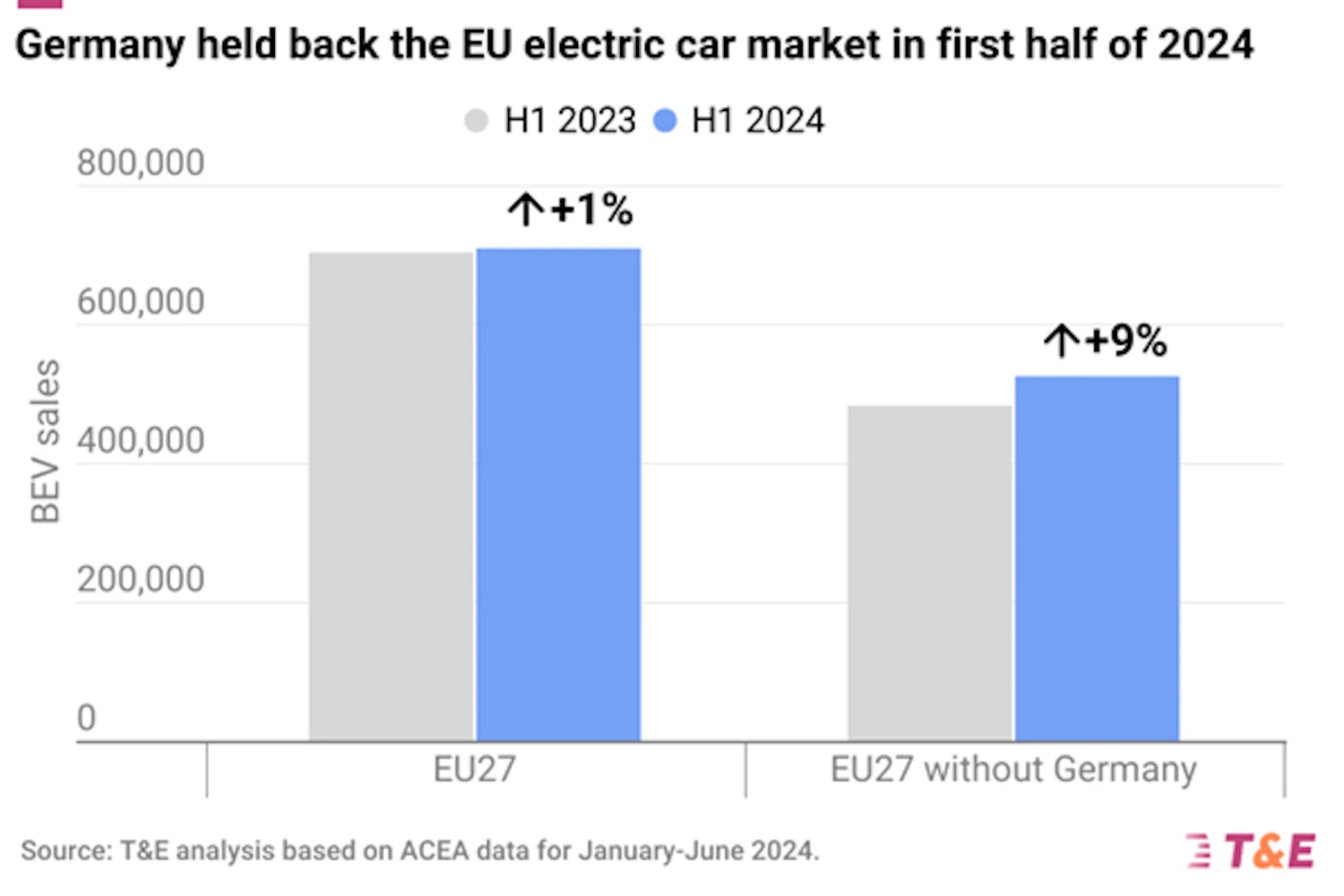

According to research from environmental think-tank Transport & Environment (T&E), Germany’s 16.4 per cent fall in electric car sales dampens the rest of Europe’s numbers. T&E’s numbers show that with the German figures included, Europe’s electric car sales grew by just 1.3 per cent in the first half of this year. Remove the German figures, and that figure improves to 9.4 per cent growth.

So, what is holding back the German electric car market? The answer seems to be that the German government suddenly and abruptly removed all purchase incentives for electric models. As T&E claims: “A stable and supportive regulatory environment is key to avoiding stagnation and locking in investment.” The think-tank called on German lawmakers to follow Belgium’s company car policy, which sets attractive depreciation rates for electric cars and phases out depreciation for combustion engines. As a result, BEV sales in Belgium increased by 48 per cent in the first half of the year.

Is this just a German problem?

Lucien Mathieu, cars director at T&E, said: “Germany is the sick man of Europe when it comes to electric cars. Meanwhile, markets which have strong, predictable incentives for EV adoption are reaping the rewards. Germany’s CDU [Christian Democratic Union - the current leading party in the German government — Ed] lawmakers in Brussels should stop trying to weaken the EU’s 2035 target and instead actually promote electric vehicles.”

Aside from Belgium, other European markets are marching ahead when it comes to electric car sales. In France, thanks in no small part to a new series of grants aimed at making it easier for low-income households to get an electric car, sales of battery-powered vehicles grew by 14.9 per cent. In Italy, which has just launched a new series of EV-buying incentives, sales grew by seven per cent, while in the UK, the ‘ZEV Mandate’, which enforces a minimum number of new electric car sales per manufacturer, there has been a 9.2 per cent boost in sales.

How is Ireland doing?

In Ireland, the picture is actually worse than that of Germany, although obviously, our far smaller total numbers don’t massively affect the average figures. According to the Central Statistics Office, the number of new electric vehicles taxed for the first time in Ireland fell by 25 per cent in the first half of the year.

Those electric car figures need to be seen against the backdrop of the wider European car market, which has, if not quite stagnated, then certainly slowed down a lot. Total new car sales across Europe rose by four per cent in the first half of the year, and that slowing of growth is in no small part due to the cooling of the ardour for electric vehicles. Felipe Munoz, Global Analyst at JATO Dynamics, said: “Europe’s growth is becoming more moderate - still far from levels seen pre-pandemic due to a more complex operating environment, including emissions regulations, increasing prices of vehicles, and barriers facing the adoption of electric cars. Since the semi-conductor shortage, electric vehicles have been the main driver of growth. It’s therefore vital that over the next six months, the industry does all it can to dispel uncertainty surrounding the EV market, including how EU tariffs on imported electric cars from China will impact the affordability of these vehicles.”