With €3.5 billion needed to be raised to fund the country, the nation has braced itself for the fifth of eight proposed 'austerity budgets'. Good news has come with the announcement that our political class will feel some of the pain with un-vouched expenses abolished and a 10 per cent reduction in overall expenses, but how has Budget 2013 affected the motorist? Not as bad as it first seemed.

Split Registration

As has long been suggested, from January 2013 the year will be split in two (from a registration plate point of view) with cars registered between January and June bearing '131' plates and those registered later in the year '132' plates. This change has long been put forward by a motor industry that sees 80 per cent of its business done within the first three months of the year and it is hoped that the new registration will balance new car sales out over the year, saving jobs that have been on a knife edge for years. It also handily circumvents the dreaded '13' plate, ideal for those who suffer from Triskaidekaphobia.

Petrol and Diesel Increases

Are you sitting down? While Excise Duty has increased on cigarettes and alcohol it has not increased on petrol and diesel. There was an expectation that this oversight would be corrected by an increase in Carbon Tax that applies to all types of fuel - from coal to aviation fuel - but unconfirmed reports suggest that while Carbon Tax has been increased by €10 per tonne from May 1 and €20 per tonne in 2014, it will not be applied to either petrol or diesel. We will update when we receive confirmation on this.

On the upside it does mean that it will not cost anymore to drive across the border to pick up cheap fags and booze. We jest!

Motor Tax

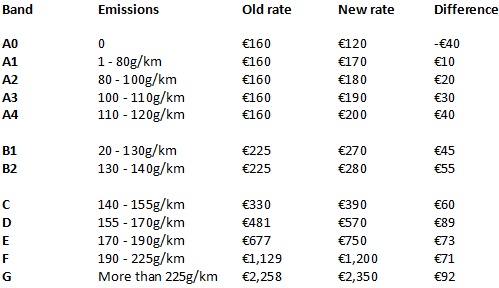

In last year's Budget, Finance Minister Michael Noonan essentially admitted that the emissions based system introduced by the Fianna Fail / Green Party coalition was inherently flawed and would have to be addressed before the Government's coffers emptied. The answer is to split the two lowest tax bands. So there are now five bands (A0 -A4) in tax Band A and two (B1 and B2) in Band B. The justification for this is "The higher rate of increase in motor tax for cars taxed on the basis of CO2 reflects the comparatively lower rate of tax for these cars compared to those taxed on the basis of engine capacity, and this provides a degree of protection for the tax base" or in other words those who bought new cars since 2008, under the lure of cheaper road tax, are not paying the State enough and this must be rectified. The handy table below explains all the changes for cars with emissions based tax including the new bands:

Despite the success of the emissions based system the majority of people still own and tax cars under the old engine capacity system and, while there are inevitable increases for owners of these cars, they are maybe not as hard to swallow as those with newer cars. For example, an owner of a pre-2008 car with an engine capacity of 1,400cc (the most popular engine size at the time) faces an increase of €27, while the owner of a car in the 110-120g/km emissions band (what would have been the most popular prior to the band split) faces an increase of €40. Here's a full table of the changes for pre-2008 models:

Vehicle Registration Tax (VRT)

As Vehicle Registration Tax (VRT) is also linked to emissions it too has changed to take into account the new tax bands. The 14 per cent tax rate, previously applied to all tax Band A vehicles now only applies to Band A0 and A1. As you will see from our table below on higher bands there is a one per cent increase for every step up the ladder you take until Band C with two or three per cent increases applying after that.

A1: - : 0 - 80g/km: - : 14%

A2: - : 81 - 100g/km: - : 15%

A3: - : 101 - 110g/km: - : 16%

A4: - : 111 - 120g/km: - : 17%

B1: - : 121 - 130g/km: - : 18%

B2: - : 131 - 140g/km: - : 19%

C: - : 141 - 155g/km: - : 23%

D: - : 156 - 170g/km: - : 27%

E: - : 171 - 190g/km: - : 30%

F: - : 191 - 225g/km: - : 34%

G: - : 226g/km: - : and over 36%